This means that the combined worth of all the splits of a US$22 stock bought then is around US$32,000 (RM132,704) today. If we calculate the price basis split-adjusted technique, the value of a single Apple stock has risen by at least 144,900 percent from the day of the IPO in 1980 to 27 August, 2021. The market capitalisation remains the same. Shareholders own more stocks following a split but the value of each of them gets divided between the new ones created.

The stock has split five times since the IPO, so on a split-adjusted basis the IPO share price was US$.10.”Įvery time Apple stocks appeared to be going through the roof, they were split to ensure that new investors can buy shares. The answer to this “confusion” is called split.Īccording to Apple’s Investor Relations FAQ, “Apple went public on 12 December, 1980, at US$22.00 per share. But that is a long, long way off the mark. To a layman, it would seem that a stock that was worth US$22 (RM91) in 1980 has only risen by around six times to date. So why is it that its share is trading at US$145 (RM601) at the time of writing on 27 August 2021? The highest ever that an Apple stock commanded was around US$702 (RM2,910) in September 2012. In August 2020, it became the first publicly listed US company to go past US$2 trillion (RM8.3 trillion) in valuation. This is why Apple stocks are among the most profitable investments. Its tremendous popularity and ability to launch products in the market that are more advanced than those before directly affects its stock prices.

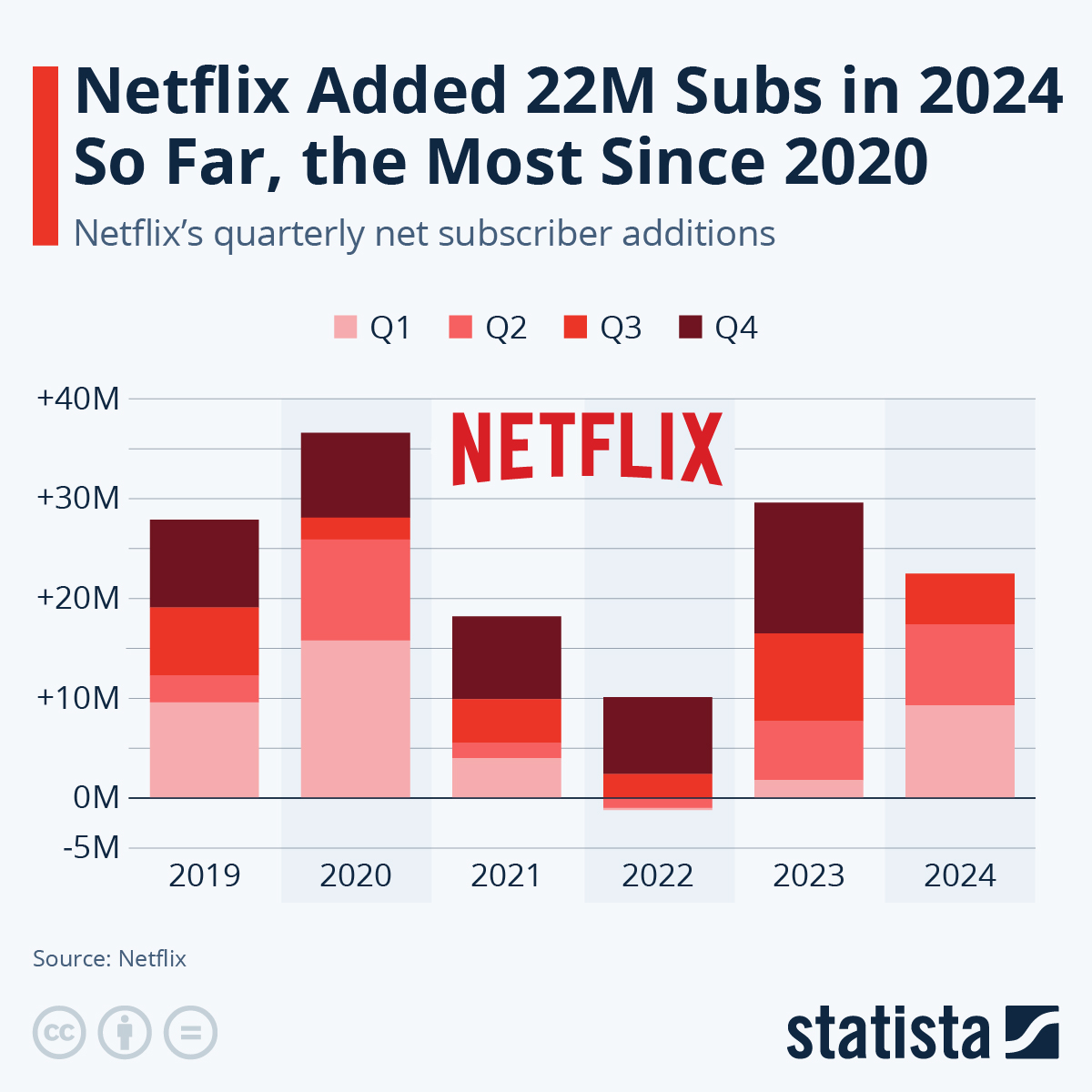

From the iconic iPhones and Macs to advanced wearables, tablets, home technology and the most popular virtual assistant, Siri, Apple has been at the forefront of a technological revolution that has changed user experience. This was the first time anyone could remember Netflix’s leadership saying that competition was negatively affecting the company’s streaming business in a significant way.One of the world’s most successful technology companies, Apple Inc., has become an essential part of the daily lives of millions around the world. A small DVD-by-mail service from Los Gatos, Calif., had seen into the future time and time again, outflanking much larger players to remake Hollywood in its image. Its remarkable success over a 25-year history had instilled in staff a belief that it could never lose. As executives followed Wang onto the stage to outline ways they could reverse the slide, many employees started to grasp that Netflix was in trouble. Netflix’s growth had sputtered in recent months, putting the company on pace to lose subscribers for the first time since 2011. But as soon as he ceded the stage to Spencer Wang, the vice president for finance, investor relations, and corporate development, the mood in the room began to darken, according to two people who were present but aren’t authorized to talk about it. A couple of years into the streaming wars, it looked as if Netflix had not only survived but emerged stronger.Ĭo-Chief Executive Officer Ted Sarandos, who turned Netflix into an award-winning powerhouse, took the stage to open the company’s annual business review meeting after a brief sizzle reel recapping its many hits. Netflix had also broken through at Hollywood’s biggest awards shows, winning two of the top three Emmys and receiving 27 Oscar nominations, the most of any company. It added 36.6 million customers in 2020, a record, and its aggressive investment in original content paid off in 2021 with the French crime show Lupin and the South Korean thriller Squid Game, two of its most popular programs ever. The company had thrived during the pandemic. employees gathered on the second floor of the Anaheim Hilton Hotel expecting to hear good news.

Around noon on Wednesday, March 16, hundreds of Netflix Inc.

0 kommentar(er)

0 kommentar(er)